Chatbots in Insurance

Deliver instant support, automate policy inquiries, and simplify the claims process with our managed chatbot solutions, designed specifically for the insurance industry.

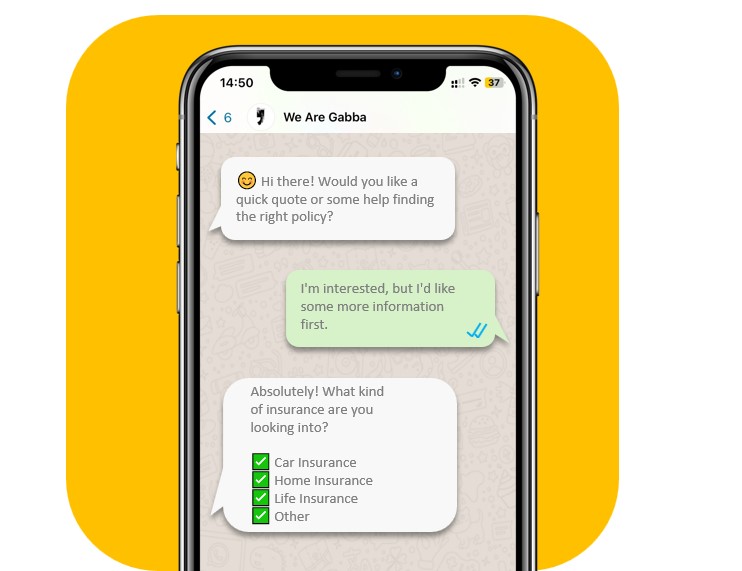

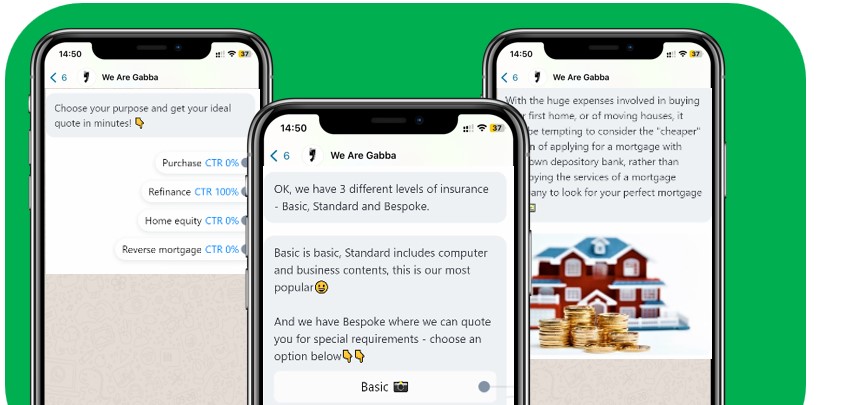

Turn Website Visitors into Qualified Leads with Conversational Lead Capture on Messaging Apps.

Capture visitor information and preferences instantly through engaging chatbots on WhatsApp, Messenger, and Instagram.

Empower Policyholders with Instant Answers 24/7

Our chatbots handle routine policy inquiries, provide instant quotes, and guide customers through self-service options, freeing your agents for complex cases.

Simplify Claims with Automated Chatbot Assistance

Guide policyholders through the claims process, gather necessary information, and even initiate the first notice of loss (FNOL), accelerating claims resolution.

Gather Valuable Customer Insights with Interactive Chatbot Surveys

Collect feedback, gauge customer satisfaction, and identify areas for improvement with engaging chatbot surveys that deliver real-time data.

WhatsApp: Your direct connection to your customers.

Forge lasting customer connections: Messenger delivers your message directly, building authentic relationships for sustainable growth.

We’ve now learned that we shouldn’t discount ourselves from different types

of digital technology, even where customers

are in the 50+ age bracket.

We’re very confident that our web and

Facebook chatbots will revolutionize how we

market ourselves, reaching people in ways

we’ve never been able to before.

Thank you Gabba!”

Our Infocus Chatbot has enabled us to engage initially at arms-length with website ‘shop window’ browsers who would otherwise disappear into the online distance without so much as a nod or a wink!

Buyers who previously found it easier to leave are brought closer by the chatbot. It also sieves out tyre-kickers without being a drain on valuable human resources

Follow Us